-

The placement showed investor preference for slightly riskier aggregate deal.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The industry has continued to build and innovate through a third strong year of performance.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

New catastrophe reinsurance Syndicate 2359 has an approved stamp capacity of £100mn.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

The hedge fund had significant investment aims for the London market.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The tech firm is building a joint stock company with insurers and investors.

-

It is understood that CyberCube has been considering a sale of the business.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The headcount at the start-up now stands at around 40.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

AIG, HDI Global and others have settled, while Chubb’s fight continues.

-

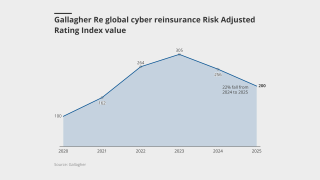

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The announcement spurred a quick spike in stock market valuations.

-

Torrey Pines Re is split among three tranches of notes.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.