-

The placement showed investor preference for slightly riskier aggregate deal.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

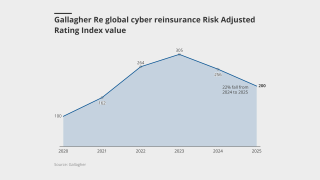

The industry has continued to build and innovate through a third strong year of performance.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

It is understood that CyberCube has been considering a sale of the business.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

Novelty premiums will likely fade once investors are more comfortable with the risk.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

The deal is offering a multiple of 11.3x on the expected loss.

-

The bond offers a multiple of 11.3x based on a modelled expected loss of 0.93%.

-

The bond is offering a spread range of 950-1,050 basis points.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Building better exposure datasets could draw a broader range of investors.

-

The insurer currently has $300mn of reinsurance limit from cyber cat bonds.

-

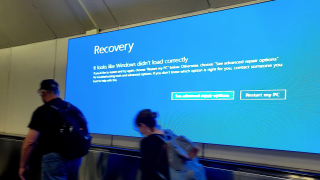

The July downtime will increase relevance, demand and innovation for the market.

-

The carrier estimates the total industry loss for the Microsoft/CrowdStrike outage at around $1bn-$2bn.

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The profile of the loss could provide comfort to investors around exposure diversification.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.