-

Third-party investors made a net income of $415mn in the quarter.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The carrier will continue to write assumed retro in Bermuda.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

A cat-focused vehicle is “the missing piece” of Hannover Re’s ILS offerings, said Silke Sehm.

-

The allocation is around 3% of the fund’s total assets.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Toh joins from Nephila, where he spent the last decade, bringing expertise in ILS.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

Founder and CEO of Nascent Andre Perez will join Sephira’s board of directors.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

Improved performance and growing investment returns played a role in the upgrade.

-

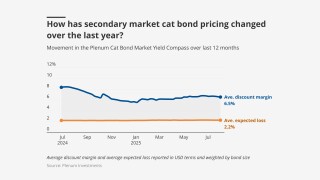

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

Bellal Rahman joins from Catalina Life Re, where he was head of finance for two years.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

Charles Mixon joined the firm a year ago in a business development role.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The economic loss from the event was around EUR7.6bn.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Losses were primarily driven by personal property lines.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The sponsor extended two notes issued in 2022.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

The investment bank had stopped offering ILS services last September.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

The group claims the White House is undermining disaster preparedness.

-

Benjamin Baltesar spent more than six years at Euler ILS.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

This is the latest in a string of appointments made by the firm’s ILS unit.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The forecast has increased since the early July update due to several additional factors.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

The unit said capital in the ILS market remains more than adequate to meet rising demand.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Markel announced the sale of its global reinsurance renewal rights to Nationwide.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The consultation period around UK ISPVs was opened in November last year.

-

George Cantlay will also assume the additional position of president of the Bermuda business.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The proposed reforms are designed to put the UK’s regulatory framework on par with Bermuda and the US.

-

He replaces Andrew Hughes, who held the role since 2021.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

Matthew Towsey has spent 14 years at Aon.

-

US events accounted for more than 90% of global insured losses.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Former ILS lead Matt Holland left the company in May.

-

He had spent 10 years at Securis, with seven of them as COO.

-

His last role was ILW practice leader at Acrisure Re.

-

The weather-modelling agency is predicting a below-normal season.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The total yield was 11.03% as of 27 June, including 4.3% of risk-free rate.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The company said the reduction was due to years of steady improvements.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

The body said cat bonds are closer to an insurance product than a security.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

Harry White has been with Verisk for 14 years, while Ted Gregory has been with PCS for 12.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The sidecar renewed at $230mn for 2025.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The investment is a response to shifts in stock-bond correlations.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

She was previously head of investor relations and business development for North America and Australia at Securis.

-

This followed a $650mn fall in April, after management change of the fund.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

A total $225mn of fresh limit entered the market across two deals.

-

The bond will provide protection for storms, quakes and fires in seven US states.

-

The bond protects against losses in the US, Canada, Europe and Australia.

-

The $2.59bn renewal is up 45% from last year.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The ILS market has won market share at the top of programmes as buying expands.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The Italian sponsor has $237mn of limit maturing this July.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.