ILS

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

There are various routes for ILS managers wanting to access the diversity of Lloyd’s underwriting.

-

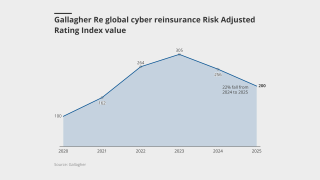

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Investor interest is warming up following a colder spell over the past several years.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

Mory Katz joined the broker earlier this year.

-

The funds will combine credit and ILS holdings.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

The allocation is around 3% of the fund’s total assets.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

Bellal Rahman joins from Catalina Life Re, where he was head of finance for two years.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

Charles Mixon joined the firm a year ago in a business development role.

-

The resource was developed by leading ILS managers and investors.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The leadership’s commentary spotlighted to value of ILS to the group.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The investment bank had stopped offering ILS services last September.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

The consultation period around UK ISPVs was opened in November last year.

-

He replaces Andrew Hughes, who held the role since 2021.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

Matthew Towsey has spent 14 years at Aon.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Bermudian ILS manager has recently changed its name from Mereo Advisors.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

The third-party capital manager is a new entrant to the retro space.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Harry White has been with Verisk for 14 years, while Ted Gregory has been with PCS for 12.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The pension plan has been allocating to ILS since 2005.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

Fales will focus on creating investment opportunities for the carrier’s specialty reinsurance portfolios.

-

The platform is based in Bermuda and will focus on strategic capital partnerships.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Investors want transparency from managers regarding the impacts of climate change.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The ILS manager also swung to an operating profit after posting a loss in Q1 2024.

-

The casualty ILS business now has $175mn in capital.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

The carrier increased its cession by around 13% year over year.

-

He joined what was then Credit Suisse ILS in 2019, moving from Hiscox Re & ILS.

-

Fellow Swedish pension fund AP3 is phasing out its ILS allocation after being active in the sector since 2008.

-

He joined Nephila in 2023 from Lancashire as a senior underwriter.

-

Gokul Sudarsana has been with the company since 2020, having joined from Deloitte.

-

The Swiss rail pension scheme has been cutting its ILS allocation since 2018.

-

Suzanne Wells is also joining the company from Arch as COO.

-

The asset manager has hired Rom Aviv as head of ILS.

-

LA wildfire-exposed ILS positions experienced further declines.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

Lara Martiner joined Allianz in 2011 as group legal compliance officer and legal counsel.

-

Industry sources estimate the market to be around $3bn.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

Indirect exposure to cat risk through long-term investors gives Markel optionality.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.