ILS

-

The new generation of vehicles is driven by a lively legacy market and innovations in structuring deals for long-tail risk.

-

One of the ongoing trends within the ILS market over past years has been an increasing demand from existing investors to look for something different within their portfolio.

-

The Zurich-based ILS manager expects to be underwriting some specialty business from 2022.

-

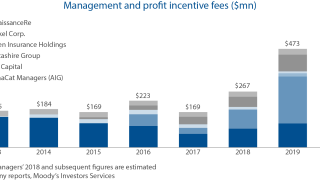

The convergence of traditional reinsurance and ILS has seen reinsurers’ fee income rocket over the past three years.

-

The lack of modelling expertise for higher-frequency, secondary ‘all peril’-type losses is putting a rosier tint on catastrophe bonds

-

Ongoing high claims from risks such as winter storm, wildfire or convective storm are playing into the climate-change debate over whether and to what extent cat reinsurers are mispricing their business.

-

Schroders Capital ILS chairman Dirk Lohmann said the shift could be due to yield compression in the bond market.

-

Carriers will not necessarily accept smaller returns in exchange for high ESG scoring vehicles and risks must be properly priced, according to Dirk Lohmann, chairman of Schroders Capital ILS.

-

The deal covers the reinsurer’s worldwide cat XL book, as Scor plans to ramp up P&C growth.

-

The former Willis Re vice president and head of European ILS joins as GC’s London ILS leader Des Potter is set to retire.

-

The broker expects ongoing single-digit growth within the ILS market.

-

It is not so much the size of the hit, as the regularity of moderate cat events that is worrying risk-takers.