-

The deal freed up capital held against deals written in 2019 and 2020.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn

-

The CEO cited ‘no change’ in appetite from a shift in the capital mix.

-

The manager is looking to buy positions on the secondary market.

-

Schroders moves into fifth place in the Insurance Insider ILS leaderboard.

-

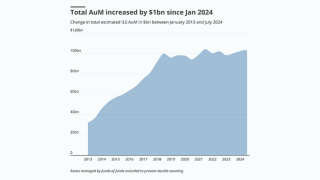

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

The combined Twelve-Securis entity would be a top-five ILS firm currently.

-

More than 30% of the fund's AuM is allocated to US windstorm-linked bonds.

-

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

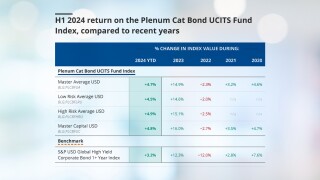

This is lower compared to 8.2% recorded by the index in H1 2023.