Howden

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

In 2024, MGA GWP reached approximately $20bn in Europe.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The company is a wholly owned subsidiary of AmTrust Financial.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

The London D&F market will shoulder most of the losses.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

Paul Poschmann joins from Gallagher Re, where he was a divisional director.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

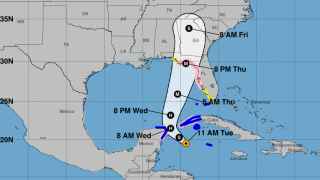

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

The executive has held senior alternative capital roles at Aon and Guy Carpenter.

-

The firms’ partnership preceded Japan's first ‘megaquake’ warning.

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

The broker is entering the Japanese market with a focus on ILS.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Additional capacity for upper-layer coverage is driving rate reductions, the broker says.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Diversification in perils and regions can help the market grow.

-

This follows the broker's rebrand in October last year.

-

Arm is based in Guernsey and has a Bermudan management licence.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.