Fermat Capital Management

-

Hole will spearhead the launch of the underwriting and analytics platform.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

This followed a $650mn fall in April, after management change of the fund.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

Brokers expect strong competition at remote risk layers at the 1 January renewal.

-

The executive explored ILS options as MD of hedge fund Horton Point post financial crisis.

-

The moves mark a major step in realising “trillion dollar” casualty ILS potential, according to Ledger Investing CEO Samir Shah.

-

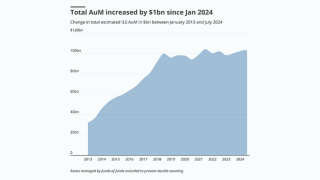

The ILS manager leaderboard demonstrates the ongoing popularity of cat bonds.

-

-

Of the 18 top-tier ILS managers, 10 recorded growth, while eight were flat or down.

-

Fermat managing director Nelson Seo has forecast that continued high demand could push ILS issuance volumes even higher in 2024.

-

The cat bond market has benefited from hardening rates and more remote structures.

-

The acquisition gives UK asset manager Liontrust a broader European footprint and cat bond products.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

The ILS manager said the cat bond sector could double to become a $70bn market in the next three to five years.

-

The headline market drop in AuM belies a more lively growth story for funds operating outside of the ILS major league.

-

The two ILS firms were among those participating in a $20mn fundraise for Elpha Secure Technology.

-

The figures include funds managed by ILS manager Fermat Capital Management.

-

The hardening rate environment in Florida provided a mid-year opportunity for some, but overall there was little growth.

-

The firm, which markets Fermat-managed ILS funds, did not specify the size of the new investor commitment.

-

“Pass-through” tax status would help SPIs issue US-based ILS, Joanna Syroka said.

-

Seo and Millette both expressed optimism about inflows into ILS over the coming months.

-

John Seo noted the diversification benefits ILS offers in tumultuous times as cat bond segment avoids spillover from market turmoil.

-

Models need to be the start of the analysis not the end, Fermat boss John Seo said at Trading Risk’s event in New York.

-

Avoiding a “bucketing” approach to risk-taking will help the ILS industry fill in the insurance protection gaps, according to Fermat managing director John Seo.

-

The reinsurer helped Fermat to write $100mn for the Florida state reinsurer’s 2019 cover.

-

Returns from ILS funds tracked by Trading Risk fell to an average Q1 return of 0.63 percent to 0.65 percent in cat bond and multi-instrument funds.

-

The ILS investor says 7 percent annual returns have made the asset class an attractive opportunity for the fund.

-

The firm’s Fermat-managed ILS portfolios lifted assets under management to $3.3bn in Q3.

-

The average second quarter returns for a group of ILS funds tracked by Trading Risk has increased to 1.36 percent, compared with 0.79 percent for the same quarter last year.