The case has also prompted the industry to revisit protocols around letters of credit (LOCs), including looking at the limits of know-your-client (KYC) and anti-money laundering (AML) checks.

The SAC Act 2000 made it easier and more cost efficient to register segregated accounts companies (SACs) and segregated accounts, or cells, and has proved a popular framework for counterparties to transact collateralised reinsurance agreements in Bermuda.

The test of SAC regulation arising at this stage in the fallout of the Vesttoo LOC scandal centres on three key issues.

Firstly, who owns, and has rights of control over the cells and the property in them: whether it’s the SAC/transformer company, in this case White Rock, or the cell owner, in this case Vesttoo.

Secondly, whether Bermuda law provides for individual cells within a SAC to be liquidated.

And thirdly, which court takes precedent in this context — the District of Delaware Court or the Bermuda Supreme Court.

As things stand, the Bermuda Monetary Authority (BMA) and White Rock moved to assert control of the impacted cells by appointing joint provisional liquidators on 18 August. That action was stayed temporarily by the District of Delaware Court on 23 August.

A future ruling by the District of Delaware Court will decide if the stay is to be upheld, for which a date has not yet been set. Objections or responses must be filed by 29 August.

Terms of cell ownership

In a typical cell transaction, the terms of ownership of the cell are written in a shareholder or noteholder agreement issued to cell investors. As standard, this sets out the terms for the cell owner to share in the economics of the cell, without rights or obligations.

In Bermuda law, the cell owner has beneficial interests in the assets of the cell. So do the cell’s creditors, the cedants.

The test of Bermuda’s SAC law arises also because a cell is not a legal entity in its own right. This provides a space for Vesttoo to challenge whether a cell can be treated as separate from the SAC platform for the purposes of liquidation.

Sources say that the principle of cells being distinct from other cells, and cells being distinct from the general company, is well established in the industry, and that this challenge is not generally expected to hold up.

Ownership of cell assets

Another of the tests is whether Vesttoo can establish in the District of Delaware Court that it is the beneficial owner of the cell’s assets.

If it can, then the assets of the cell potentially would form part of the Vesttoo estate and would be covered by the Chapter 11 process in the US.

The focus on ownership of the Vesttoo cell begs the question of what assets are in the cells.

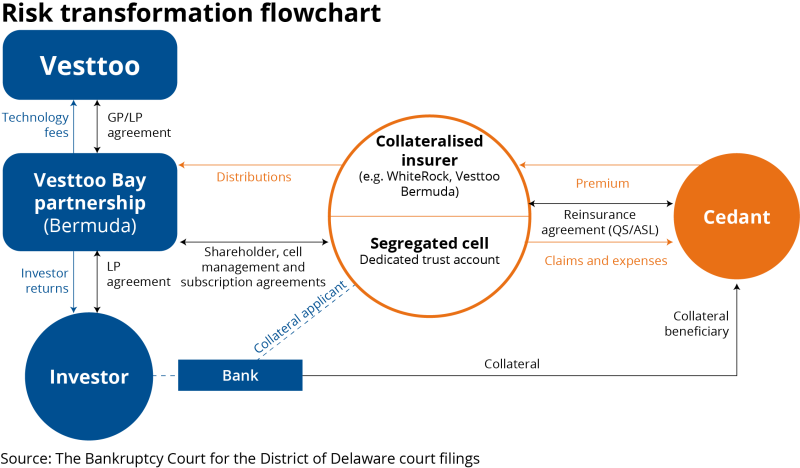

Mostly, collateral posted in reinsurance deals is transferred into a trust account. In such cases, the trustee becomes the legal owner of the assets, which are held in trust on behalf of the cedant.

Premiums are sometimes paid directly into the cell, becoming assets of the cell.

White Rock is currently seeking the return of $136.7mn from Vesttoo that was distributed from the cells, citing breach of participating shareholder agreements.

Vesttoo Bay Limited Partnership

Case filings at the District of Delaware Court show that Vesttoo completed around 45 deals with White Rock. Shares in the relevant cells were acquired by one of 21 Vesttoo Bay limited partnerships. These limited partnerships are entities formed under Israeli law.

Interests in the limited partnerships were sold to capital markets investors. The documents noted that these limited partners were “generally obligated to contribute to the Vesttoo Bay Limited Partnership (a) an account for fees and expenses, and (b) a letter of credit to provide collateral security to the cedant.”

The case has put the spotlight on protocols around LOCs, with one question being how far up the chain firms ought to go with KYC and AML investigations.

One source said: “You need to understand who is doing what when there are a lot of entities involved and when the LOC is coming from someone way at the other end. You don’t call the person they tell you to call.”

Conflict of law provisions

Finally, the courts will need to untangle which court has the superior right to hear the applications and the overall power to decide what happens next.

Often contracts will include provisions for conflicts of laws, that will specify which governing law the parties agree to abide by in the case of disputes. It may also include whether disputes are to be arbitrated or litigated.

In early August, White Rock secured a temporary order in The New York Southern District Court preventing Vesttoo from moving assets out of its bank accounts, referencing forthcoming arbitrations to be held in Bermuda.

For now, the focus is on the District of Delaware Court, and the outcome of its process to decide if the stay on the BMA/ White Rock’s claims shall be upheld.