AlphaCat Managers

-

The deal freed up capital held against deals written in 2019 and 2020.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Key names taking up senior roles at Validus include Sven Wehmeyer and Pablo Nunez.

-

The ILS executive is departing the ILS platform following RenRe’s move to buy Validus Re for ~$3bn.

-

The industry’s ability to draw new capital will hinge on the outcome of the Atlantic hurricane season.

-

Removing any competitor is a positive for ILS peers in a competitive time for fundraising, but it is not clear how much of a boost this will give RenRe.

-

RenRe will be taking control of ILS manager AlphaCat as part of its purchase of Validus Re.

-

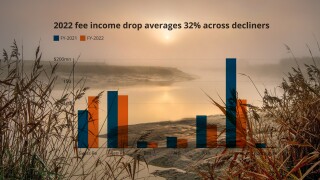

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.

-

The ILS unit earned $5mn of fee income, down by $1mn year on year.

-

Some firms have fared better than others in the competition to raise funds during the year.

-

AIG’s Q3 net cat losses of $600mn included $450mn from Hurricane Ian.

-

AlphaCat will lose a mandate worth a few hundred million dollars as part of a broader pivot on alternatives from the pension fund.

-

The group-level cat impact to the combined ratio improved 0.3 points to 1.8.

-

Third-party assets under management were up $100mn in Q1 at $3.6bn.

-

AIG took losses of $28mn for the year from its holding in AlphaCat managed funds.

-

The Dutch firm had given the AIG-owned platform a mandate that could range from EUR500mn to EUR1bn, covering US cat reinsurance.

-

AIG has disclosed that AlphaCat’s AuM was $3.5bn as of 30 September, down by $300mn from the $3.8bn reported for Q1 2021, and 17% from $4.2bn a year ago.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

The portfolio manager had been with the firm since 2018, with incoming CUO Adam Szakmary expected to take up his responsibilities.

-

Parent AIG’s cat losses remained elevated in line with the prior-year Covid-19-impacted quarter.

-

The executive had previously worked on Montpelier’s Blue Capital before his four-year stint at Hiscox Re.

-

Parent company AIG posted an underwriting loss for the period.

-

Fee income stayed flat but AIG's share of AlphaCat investment results dropped.

-

Nephila’s fall in AuM contributed to the trend of specialist firms shrinking, as reinsurer-backed assets were up modestly.